How do I set up tax?

Latest update: September 02, 2017 00:45 - Nat Dudley

The way you set taxes up in Vend depends on whether your in-store prices are displayed excluding tax, or including tax

Stores in the USA and Canada are tax-exclusive. New Zealand, Australian, and UK stores are tax-inclusive.

Setting up tax in:

Tax Inclusive Stores

Taxes in Vend can be set at a number of different levels:

- A default tax for your entire store, made up of one or more tax types

- A tax rate on an individual product for all outlets. This may be no tax, or any of the taxes you've created for your store.

Tax types can either be added from the Dashboard Getting Started wizard, or from the Sales Taxes Setup page.

Creating an individual sales tax

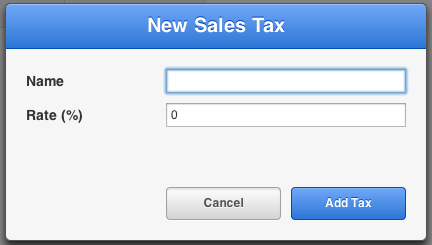

- Click the 'New Sales Tax' button.

- To set up a single tax rate:

- In the pop-up window, name your tax and type in the tax percentage

- Save your tax.

- You've now created a new tax rate.

- Complete this for each tax rate in your region.

Apply the default tax for your store

- Open the General Settings page on the Setup tab.

- In the default tax drop down, select the tax rate you'd like to apply

This tax rate is now set as the default tax for your store.

IMPORTANT: Existing products will only have their tax rate updated if they are already set to use the 'default tax' for your store. You should confirm your products have the correct tax rate.

Once you've set up your default taxes, you can apply a different rate to a particular product.

If you're a Xero user, don't forget to set up your taxes in Xero.

Tax Exclusive Store

A tax-exclusive retailer is a retailer who displays prices for products without their tax component. If your store is in the U.S.A. or Canada, this will be you.

Your taxes in Vend can be set at two levels:

- A default tax rate for each outlet. This may be a single tax rate (including no tax), or a grouped tax made up of more than one tax type.

- A tax rate on an individual product for all outlets. This may be no tax, one tax, or a grouped tax made up of more than one tax type. This tax rate overrides the outlet and store defaults.

Important: Vend's tax model does NOT support manufacturer-issued coupons, which require tax to be calculated on the before-coupon-discount-applied price. Tax in Vend is calculated after the discount is applied.

Your taxes will need to be created before you apply them.

Creating an individual sales tax

To create a new tax rate navigate to Setup - Sales Taxes and click on 'Add Sales Tax.

- In the pop-up window, name your tax and type in the tax percentage

- Save your tax.

Complete this for each individual tax rate in your region.

Your store will also have a 'no-tax' 0% rate set. You cannot remove this.

Grouping tax rates together

Once you've created your individual sales taxes, you can group them together to be applied to your store or products.

Remember, these will be itemised on your receipts.

To create a group tax:

- Click on the 'New Tax Group' button.

- Name your group tax

- Select the individual sales taxes from the drop down.

- If more than 2 taxes are required, click 'add another tax' to access more drop-down boxes.

Complete this for all the tax groups you need to create.

Apply your tax rates

Once you've set up all your required tax rates, you need to apply them to your store or products.

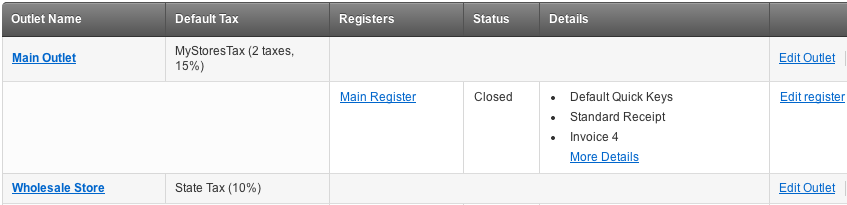

On the Taxes page, for each outlet listed in the 'Default Outlet Tax' section. you will need set the default tax rate for sales and products for that outlet.

Click the 'Edit Outlet' link next to each outlet to set the tax rate.

Important: The default tax will not apply to existing products. If you've already added products to your store, you'll need to update these.

Don't forget that you can apply a tax rate to a specific product to override these settings.

If you're a Xero user, remember to set up your taxes in Xero.

Related Articles

How do I apply a tax rate to an individual product in my tax-inclusive store.

How do individual product taxes work? Some products have different tax codes, for example fresh fruit and vegetables in some countries do not attract GST. This can be easily managed within Vend. Set up all required tax codes in Vend Choose the ...How do I apply a tax rate to an individual product in my tax-exclusive store.

Some products have different tax codes, for example fresh fruit and vegetables in some countries do not attract tax. This can be easily managed within Vend. Set up all required tax codes in Vend Choose the appropriate tax per product When you set up ...How do I set up my QuickBooks Online integration?

How does it work? The QuickBooks Online integration enables Vend customers in the US to easily post their end of day sales, payment counts, and cost of goods sold to their QuickBooks Online account. This makes it quick and easy for retailers to keep ...Set up and use Vend customer-facing Display

What is Display? Vend Display is the perfect companion for Vend Register, offering you a customer facing display using a secondary iPad or iPad Mini. Display also allows a customer to enter their own email address for email receipts or customer ...Contents of UAE VAT Tax Invoice As Per the Guidelines of FTA

If your taxable turnover - the value of the taxable goods and services that you sell and any imports - exceeds AED 375,000 in a 12-month period, or if you expect your taxable turnover to exceed AED 375,000 in the next 30 days, you are required to ...