Setting up your Vend - Xero integration

1. Turning on the integration

Important: Once a Xero organisation is linked to your Vend account, it cannot be changed. You can remove a Xero organisation from Vend, but you cannot then link a different organisation to the same Vend account. This is because all past account sales, register closures, purchase orders, and customers in Vend will remain linked to the original Xero organisation you set up.

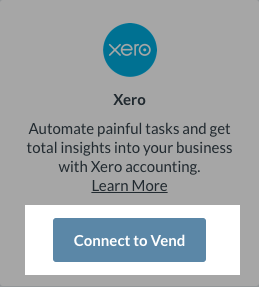

Connect to your Xero account

1. On the sidebar, select Setup and click 'Add-ons'.

2. Click the 'Connect to Vend' button for the Xero integration.

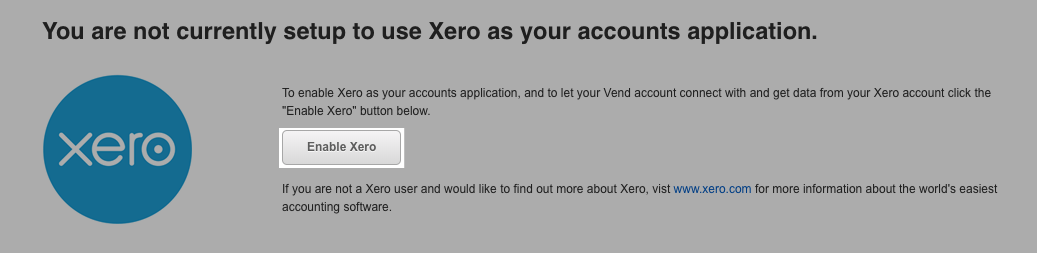

3. Click the 'Enable Xero' button.

4. Enter your Xero login information and click 'Login'.

5. Select the Xero organisation to match to your Vend store.

6. You'll be taken back to Xero settings page in Vend.

2. Sales and Purchase Account Settings

Note: You will first need to create vend specific accounts in Xero for the accounts in Vend.

Next, you'll need to choose which accounts to send sales, purchase and payment information to. Make sure you've got all the accounts already set up in your Chart of Accounts in Xero and have enabled payments for these accounts.

Note: If you have added any new accounts in Xero you will have to click reload accounts on the Xero settings page in Vend before they are available in vend to map.

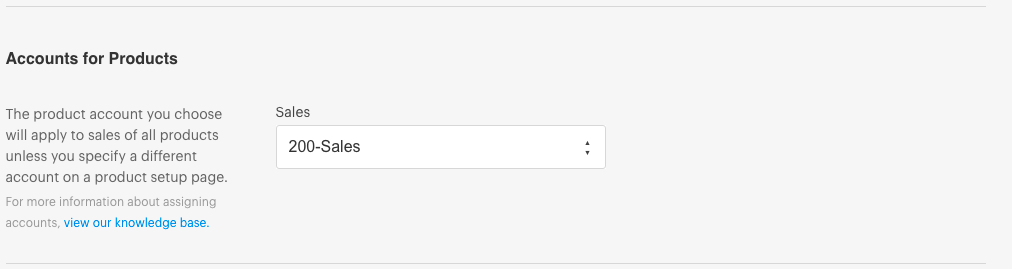

Accounts for Products

What is this?

This is the sales account in Xero which all product sales totals will be sent to by default. Send your product sales totals from register closures and account sales to a specific account in Xero. If you don't want all sales going to the same account, you can set an account for each product on the product page. Eg: Cash Sales, Credit Sales, etc.

Which accounts in Xero can this be mapped to?

- Sales

- Current Assets

- Current Liability

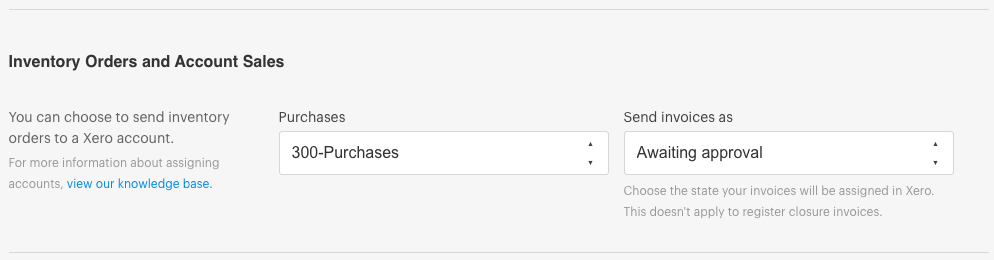

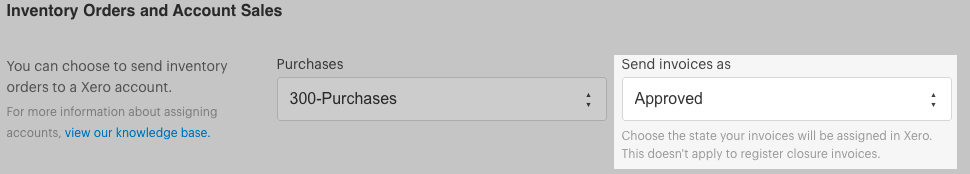

Inventory (Stock) Orders and Account Sales

What is this?

Send completed stock order totals to Xero where an accounts payable invoice will be raised. You can select which inventory orders you want to send. All customer invoices for 'On Account' sales will be sent to Xero automatically. If you don't want all purchases going to the same account, you can set an account for each product on the product page.

Which accounts in Xero can this be mapped to?

- Current Asset

- Direct Cost

- Expense

- Overhead

Rounding Errors

What is this?

Keep a record of the small discrepancies that can occur when calculating tax on small transactions. Vend will send these to your selected account when you close the register.

Which accounts in Xero can this be mapped to?

- Current Asset

- Current Liability

- Liability

- Expense

- Direct Costs

- Overhead

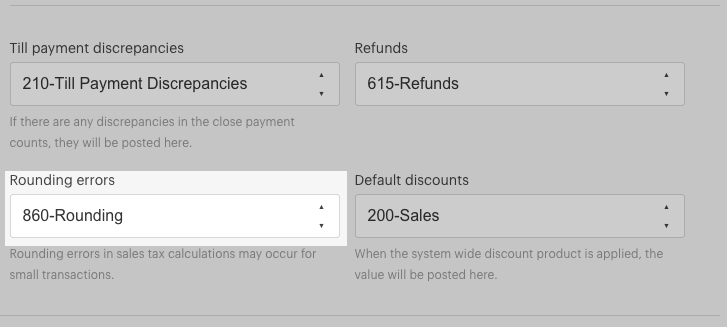

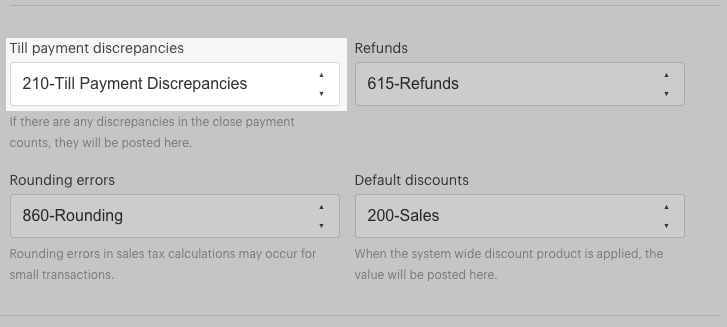

Till Payment Discrepancies

What is this?

We recommend you use Vend Cash Management to accurately track all cash movements in Vend and record discrepancies in Xero.

Track the differences between the amount expected when you close your register and the amount you count. Vend will adjust the totals of your payment accounts and the account you pick here accordingly.

Which accounts in Xero can this be mapped to?

- Current Asset

- Current Liability

- Liability

- Expense

- Direct Cost

- Overhead

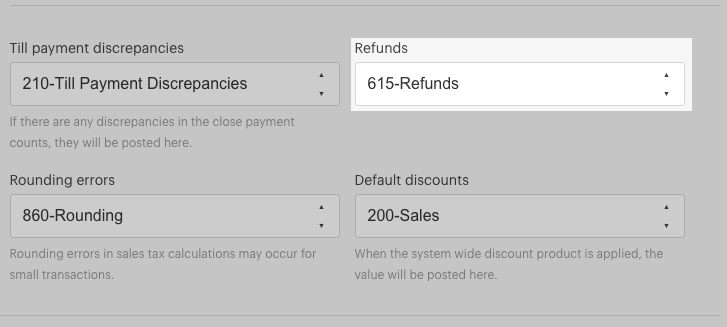

Refund Account

What is this?

Normally, these will be deducted from your payment totals for the day. However, if the total refunds issued to customers for a payment type is more than the total payments received that day, we'll post the difference to this account.

Which accounts in Xero can this be mapped to?

- Current Asset

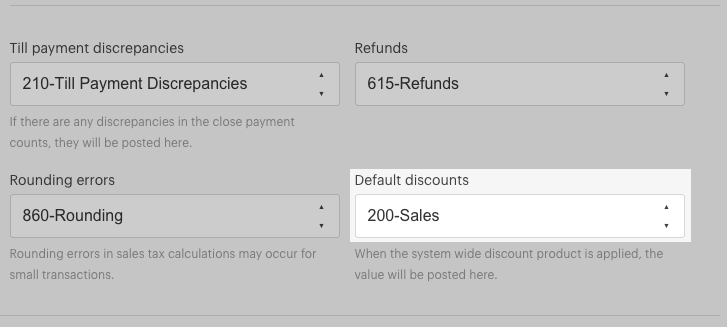

Default Discount Account

What is this?

Record the discounts you give your customers via the discount button or by using price books.

Which accounts in Xero can this be mapped to?

- Revenue

- Expenses

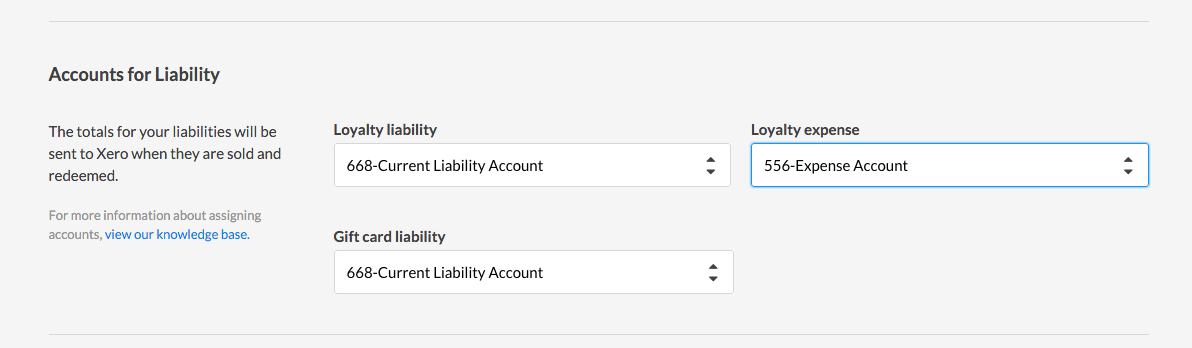

Accounts for liability

What is this?

If you're running a Vend loyalty program, you'll need to select where in Xero to post the expenses and liabilities. You can also select a liability account from Xero if you are using Vend gift cards.

Loyalty given - Track the liability to your store created by customers earning loyalty.

Loyalty redeemed - Track the expense to your store incurred when customers redeem loyalty.

If you are not sure how to set these accounts up in Xero, or which codes to use, please contact your Financial Advisor.

Which accounts in Xero can this be mapped to?

Expense (for loyalty expense) Liability (for loyalty liability)

Managing cost-of-goods-sold (COGS)

Cost-of-goods-sold (or “COGS”) are the direct costs involved in purchasing or making the products you sell.

Your COGS post to Xero and will be recognized as the goods are sold. This means when you sell a product, the cost of the product and the revenue from its sale will be recognized in the same accounting period. Easily calculate your gross profit but better yet, view your profitability against your wages, rent, marketing and other expenses to understand your true real-time position.

3. Payment Settings

Vend will send your payment totals to Xero for each payment type your store accepts. You need to select where in Xero to send these totals. Many retailers prefer to send their payments directly to their bank account feed so they can use Xero's account reconciliation feature to match them easily.

For account sales, Vend will send each individual payment to the account you specify. For all other sales, Vend will total the amount taken from your register closure and send all payments together.

You can also choose to post these payments to a clearing account. If you choose this option, you'll need to create a clearing account in Xero and ensure that payments to that clearing account are enabled in the Chart of Accounts in Xero. This account will normally be a current asset account. Make sure the account code is six characters or less. Otherwise, your payments will not post.

4. Tax Settings

Each tax rate in your Vend account needs to be matched to the corresponding tax rate you have set up in Xero. This is done in the Xero settings page in Vend.

Vend gives you the option to setup products with or without tax. You need to fill in the 'No Tax' field by selecting the Xero account you want any tax free product sales to be sent to.

5. General Settings

On Account and Stock Order invoices

You need to select the status Vend will apply to invoices sent to Xero for your On Account sales and stock orders. Select what status you'd like Vend to use when sending invoices for your On Account Sales and Stock Orders to Xero.

You can choose:

- Approved

- Awaiting Approval

- Draft

The settings will apply to both stock orders (accounts payable invoices) and On Account sales (accounts receivable invoices). This setting does not apply to register closures. All register closures are sent as approved.

Note: If you are using On Account sales, we recommend choosing 'Approved'. You are unable to receive a payment in Vend on unapproved invoices.

Setting payment due dates for On Account sales

In Vend, you can specify the date On Account invoices are due in Xero, to do this you'll need to have added a default due date in Xero.

Underneath Invoice due date, specify the date you want your customer invoices to be due. You can pick from either 'none - due immediately' or your chosen default due date in Xero.

Note: All future on account sales will use the due date you specify. You cannot specify custom due dates on an individual sale basis.

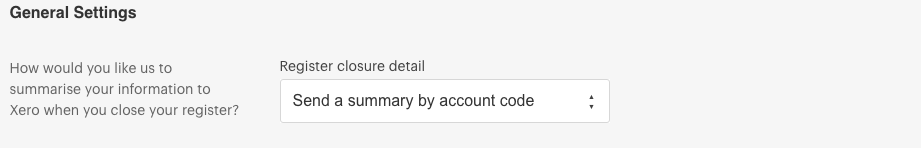

Register Closure Detail

Choose how much detail you'd like Vend to send to Xero in the accounts receivable invoice from each register closure.

You can choose:

- Detail each sale: Send detail of each sale as a separate invoice line. This means products may appear more than once.

- Send a summary by product: Send sales data totals for each product

- Send a summary by account code: Send sales data totals for each sales account code

This is a matter of preference - check with your accountant how much information they would like sent to Xero.

Note: If you are planning to enable Vend's cost-of-goods-sold feature, you will need to map a few additional fields in this section.

6. Save your settings

Click 'Save Settings' to complete the initial set up. Your Vend store is now configured to send data to Xero.

Related Articles

Troubleshooting the Vend - Xero integration

Go to the register closure, purchase orders or on-account sales - If the sale has not synced the Xero logo in front of the report name is red then - First, click on the red Xero logo. 1. Did the transaction send (logo go blue)? Yes: You're all good! ...Re-sending the Register Closure report to Xero

To resend the reports, Void the invoice in Xero. Void Xero invoice: Open invoice in Xero Remove all payments from the invoice, click on the Payment > Options > Remove and Redo Click Invoice options > Void Resend the Vend register closure: Open Vend ...Chart of Accounts in Vend - Xero Setup

In this article, we'll be walking through why a specific Vend chart of account is set up in Xero to have a flawless data sync from Vend to Xero - Vend - Purchases Send completed stock order totals to Xero where an accounts payable invoice will be ...Lightspeed Retail & Xero Integration

Lightspeed's integration to Xero seamlessly connects your point of sale to your Xero accounting software, forming a portal through which your financial data is automatically transmitted. It’s through this integration that retailers and restaurateurs ...Vend Integration Guide

Important notice These details are accurate at the time of writing this Help file. However, from time to time Vend may make further changes that are unknown to Unleashed.When importing products from Vend, Unleashed will also pull across Stock On ...